Hailey came through the line multiple times throughout the day, updating everyone on the status of the wait and meat availability. Believe it or not, they nailed both the time at which we would eat, and the amount of people that would get food. Credit to the folks in line, too, for not ordering more than they said they would once they got to the counter, which would have screwed up the count.

We asked Hailey some questions while she was around.

Q: Why does the line move so slowly?

A: The limiting factor is the meat slicer behind the counter. He is very skilled and efficient, but it still takes 1-3 minutes per person in line to prep the meat. They've tried to find more slicers, but Aaron is very particular about the cut quality, and they haven't found more people up to the standard required to run a second line.

Q: This business is so wildly successful, with demand exponentially outstripping supply. Why haven't more locations been opened?

A: The simple answer is quality control. Aaron is exceedingly demanding of the high quality product they provide, and doesn't believe it could be maintained at this time in higher volume and/or more locations. Quality comes first, by a large margin.

Q: Is the amount of meat available each day consistent? Will people who show up at 9:30a always get food?

A: Yes and no. They cook a similar amount each day, but the amount available to the folks in line varies depending on how many pre-orders for hot food have been placed.

Q: So can I pre-order and skip the line?

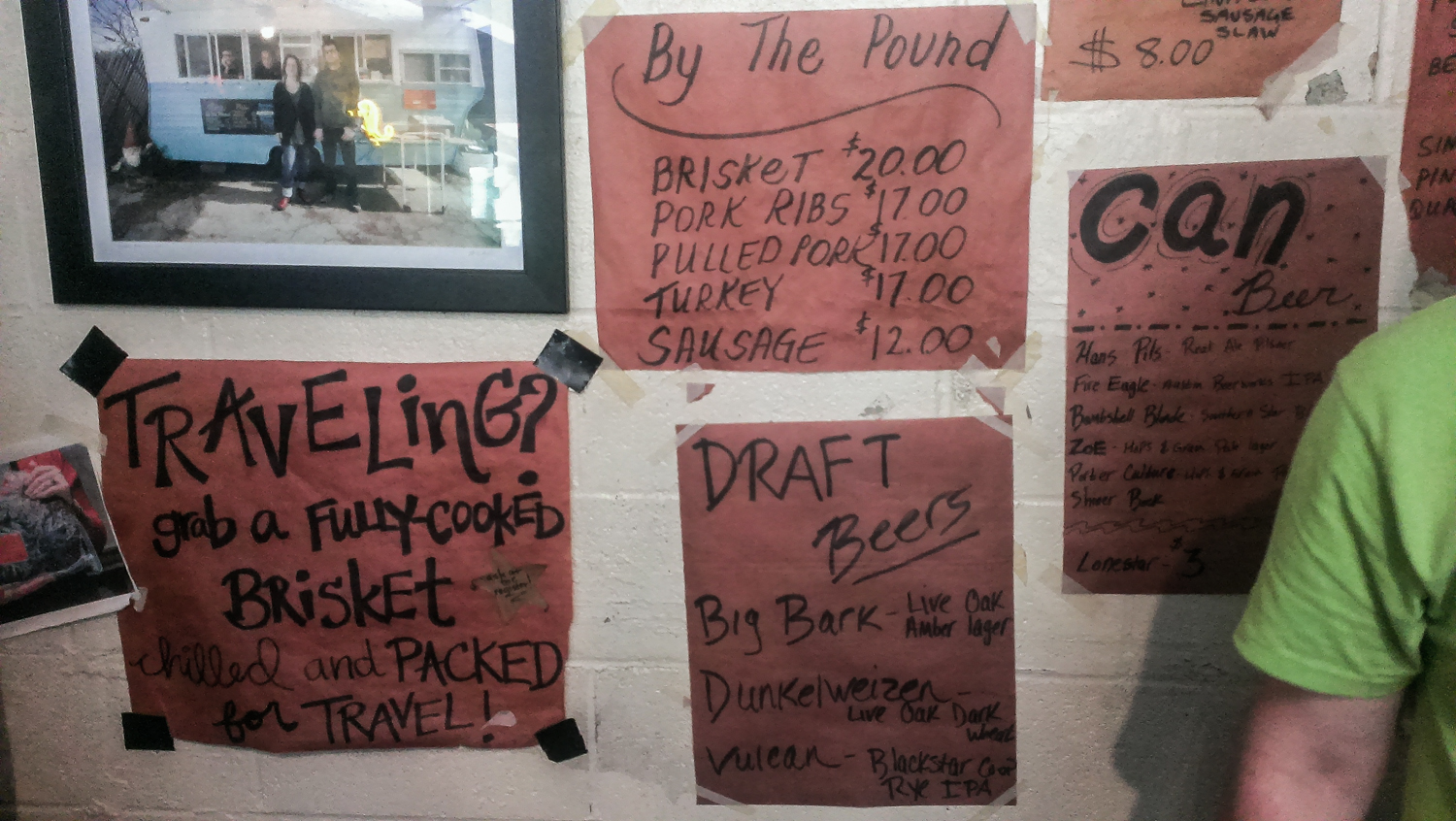

A: Definitely. However, you have to order 5 lbs. of meat, minimum, and the pre-order list is usually filled 2-3 months in advance. When they open up a time slot for pre-order, they get over 500 emails in less than an hour. There are no guarantees you will get your order, even if you get in there early. Pre-orders must be picked up between 10:00am and 10:30am, otherwise you have to wait in line to get it. Don't be late!

Q: With all the people in line, is there a problem with seating in the restaurant?

A: Not usually. There are 14 - 15 tables inside the restaurant, and because the line moves so slowly, there are generally open seats.

Q: When is the best time of day to arrive?

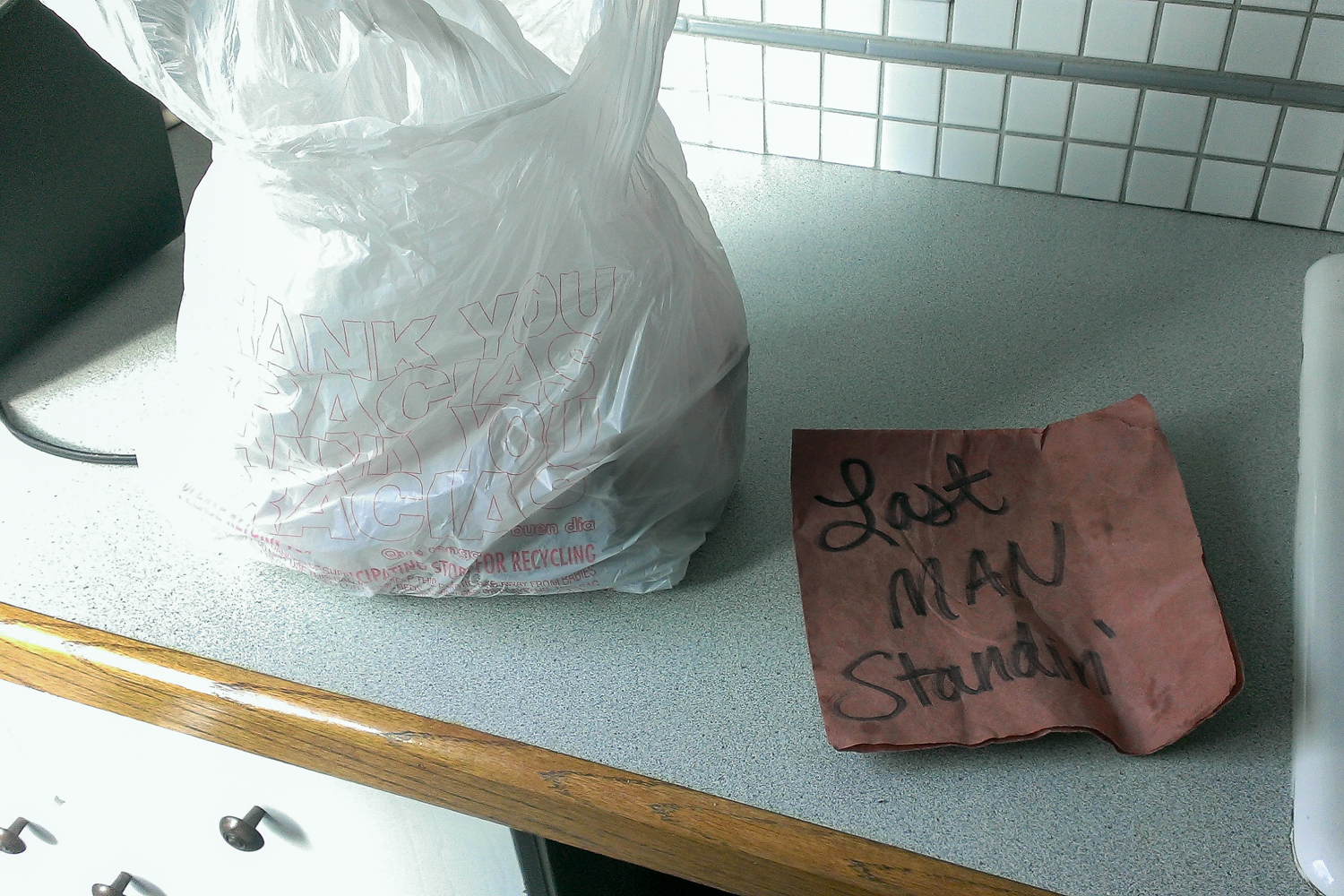

A: Your best shot at getting food with a short wait is to come between 2:30pm and 3:00pm, then take whatever is left. You might get lucky and get what you want, but if you don't, you didn't have to wait in the massive line.

Q: How long does the brisket take to make?

A: Between the meat prep, smoking, post-cooking care, and slicing, each brisket takes 44 hours worth of work.

After the Q&A, we finally made it inside. As we worked our way along, I picked up a hat and t-shirt which were in bins next to the line. Plenty of time to try them on and figure out the right size.